:max_bytes(150000):strip_icc()/GettyImages-1175682245-6358c34288f249e88ef1ae4ffe74dc43.jpg)

How Will Getting Married Affect Your Premium Tax Credit?

4.7 (437) In stock

:max_bytes(150000):strip_icc()/GettyImages-1175682245-6358c34288f249e88ef1ae4ffe74dc43.jpg)

4.7 (437) In stock

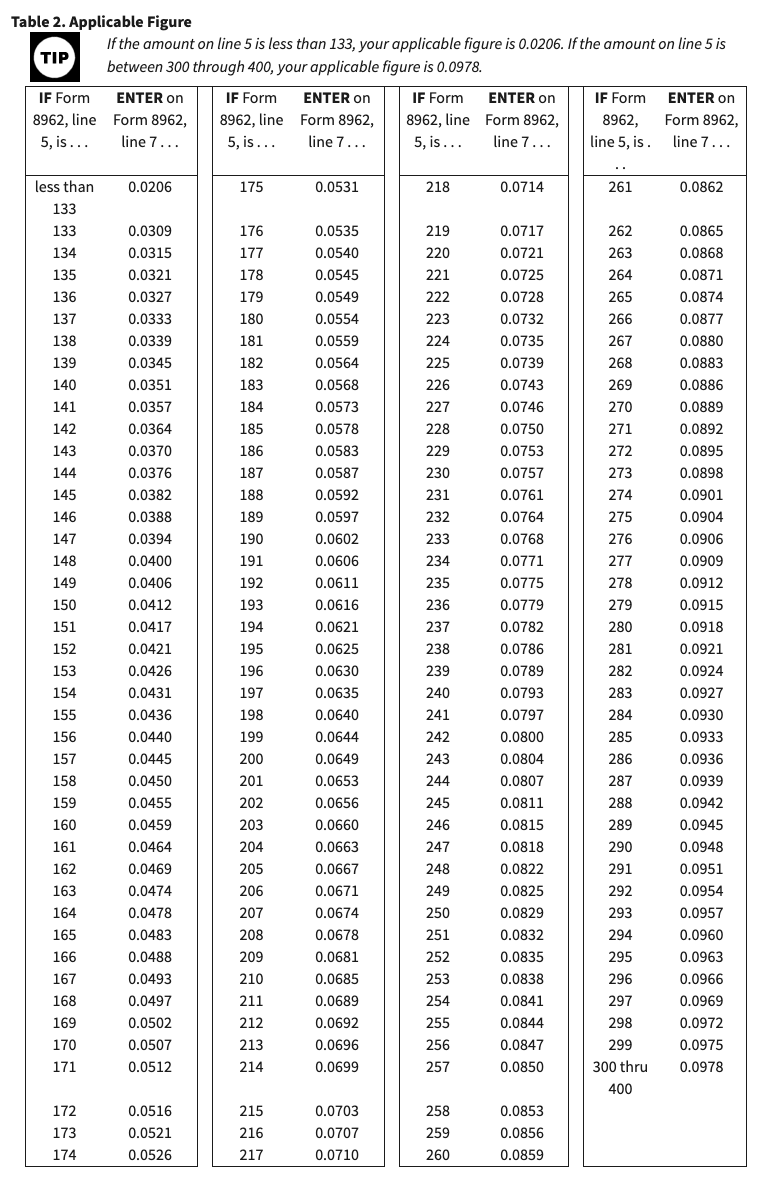

Premium tax credits are based on total household income, but the IRS has an alternative calculation you can use for the year you get married.

How Getting Married Affects Your Student Loans

:max_bytes(150000):strip_icc()/health-insurance-helps-patients-get-the-medical-care-they-require-107797664-57532c17dc894050a6d2fb3a702ce88e.jpg)

Louise Norris - Verywell Health

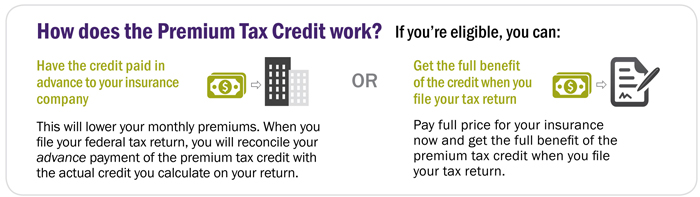

Premium Tax Credits

Tax credit vs. tax deduction: What's the difference and which is better?

What Is the Premium Tax Credit? Calculator and How It Works - NerdWallet

Mid-Year Tax Checkup 2022 - TAS

Health Care Premium Tax Credit - Taxpayer Advocate Service

:max_bytes(150000):strip_icc()/Benefits-of-Marriage-Getty-Images-FB-c97eb60d508d42768079e6dcb73f89e1.jpg)

/thmb/K07iRX1sbeWZPOHc_3O_hoP8ShY=/1

:max_bytes(150000):strip_icc()/GettyImages-527691140-61219e49958348bcafcf740c92ece06b.jpg)

MAGI Calculation for Health Insurance Subsidy Eligibility

Tax filing status and the Covered California Subsidy

What are premium tax credits?

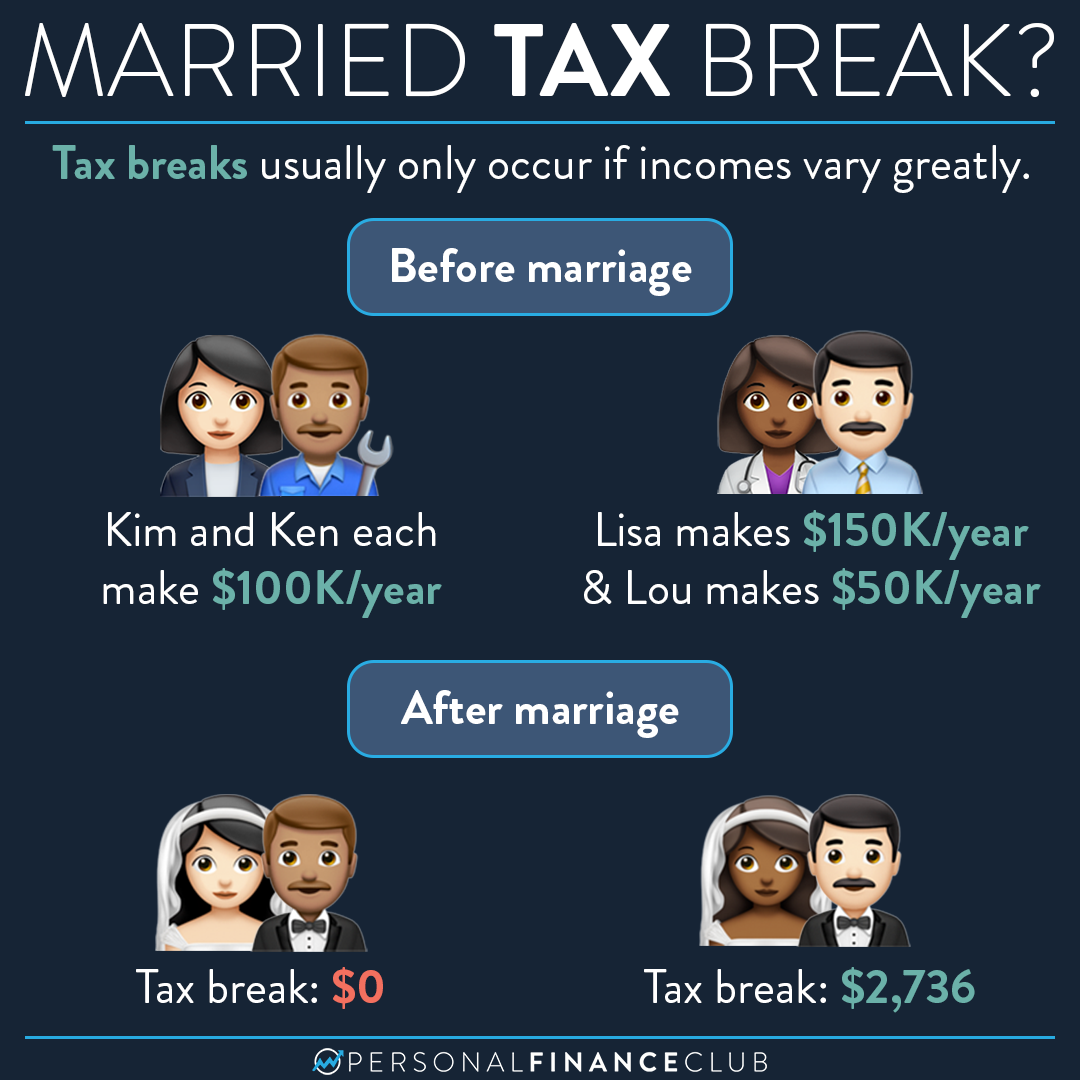

Will I get a tax break by getting married? – Personal Finance Club

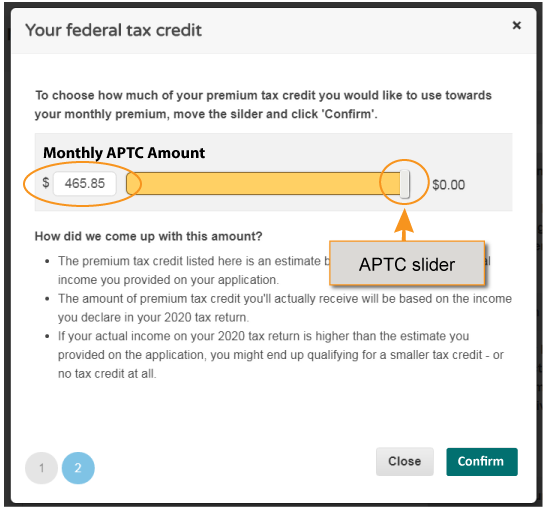

Adjust APTC Amount / MNsure

Maximizing Premium Tax Credits for Self-Employed Individuals