Non-Profit Organizations, Ohio Law, and the Internal Revenue Code

4.9 (98) In stock

4.9 (98) In stock

The relationship and interaction between Ohio law governing not-for-profit organizations and the Internal Revenue Code provisions governing tax-exempt and charitable organizations can be confusing and often misunderstood. Many people assume that one necessarily means the other, which is not the case.

Understanding the Benefits of a Series LLC - Carlile Patchen & Murphy

Free Cash Donation Receipt - PDF

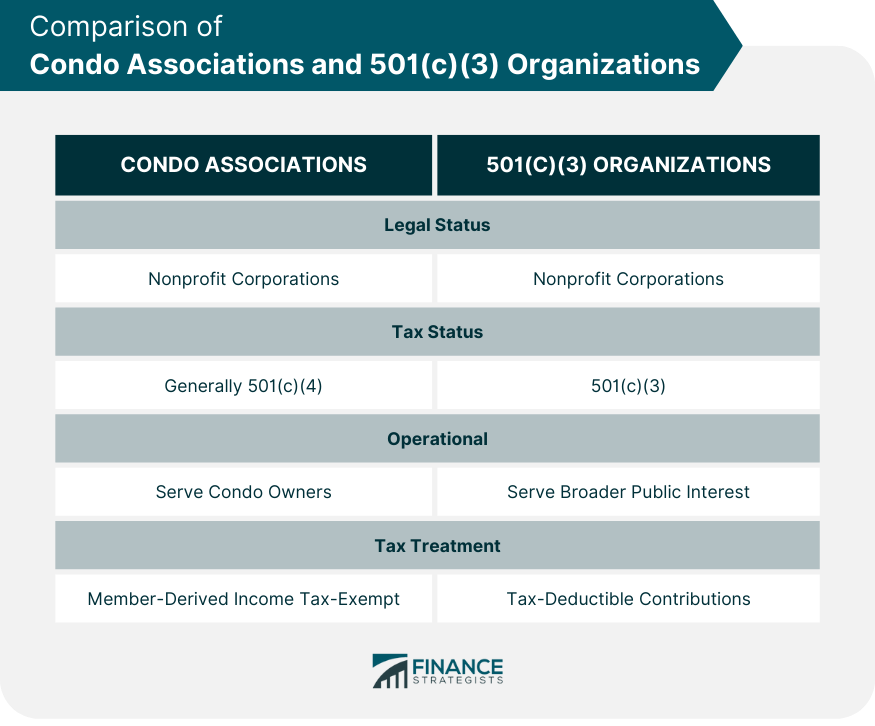

Are Condo Associations Considered 501(c)(3) Nonprofit Corporations?

Non-Profit Organizations, Ohio Law, and the Internal Revenue Code

6 Differences Between For-Profit and Nonprofit Organizations

7 Key Differences Between Nonprofit and For-profit Organizations

THE Foundation #1 NIL for Ohio State

Nonprofit LLCs - Tax Law Research : Federal and Ohio - LibGuides at Franklin County Law Library

The Estimated Value of Tax Exemption for Nonprofit Hospitals Was About $28 Billion in 2020

How to Register a Foreign Non Profit Corporation in Ohio

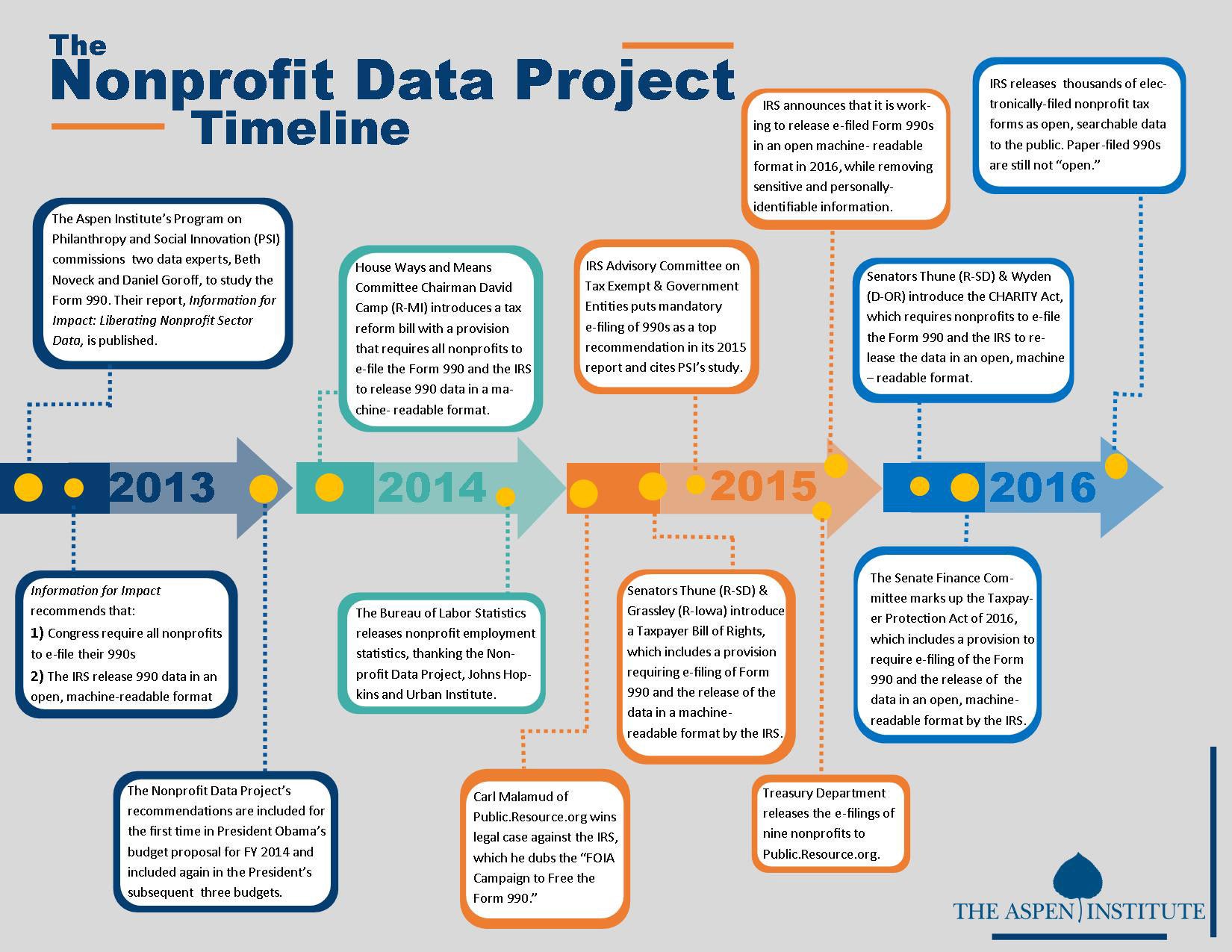

Nonprofit Data Project Updates - The Aspen Institute

Internal Revenue Code - Tax Law Research : Federal and Ohio - LibGuides at Franklin County Law Library

508c1a Nonprofit Benefits and Requirements (Call Us Today!)

How to Start a Nonprofit in Ohio