Low-Income Housing Tax Credits

4.5 (671) In stock

4.5 (671) In stock

The Low Income Housing Tax Credit (LIHTC) program was created in 1986 and is the largest source of new affordable housing in the United States. There are about 2,000,000 tax credit units today and this number continues to grow by an estimated 100,000 annually. The program is administered by the Internal Revenue Service (IRS). The […]

Managing An Affordable Property – Property Management Corner

The American Jobs Plan Would Mean Major LIHTC Expansion

The Low-Income Housing Tax Credit: Expanding The U.S. Housing

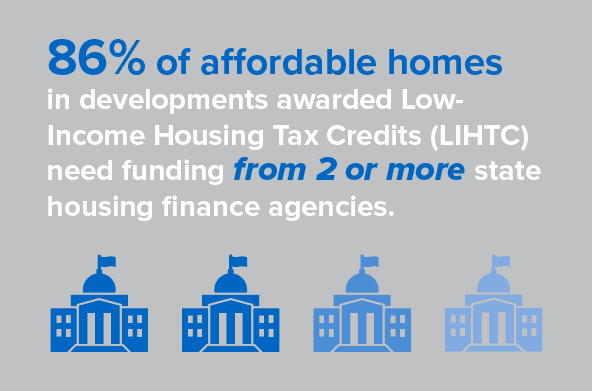

Improving Low-Income Housing Tax Credit Data for Preservation – New Report by NLIHC and PAHRC!

Creating a Unified Process to Award All State Affordable Rental

Panel approves Mo. low-income housing tax credit projects

Butler Snow 2023 Texas Legislative Updates to Low Income Housing Tax Credit Developments

Oklahoma Courts Rule Low-Income Housing Tax Credits Shouldn't Be

Developers, Owners Should Consider Solar for LIHTC Properties

City of Douglas, GA on X: Developers of low to moderate-income and market-rate housing are invited to apply for the Low-Income Housing Tax Credit (LIHTC) Program. The deadline for submissions of applications

The Effects of the Low-Income Housing Tax Credit (LIHTC) – NYU

Maximizing Wisconsin's Low-Income Housing Tax Credits