Low-Income Housing Tax Credit Could Do More to Expand Opportunity for Poor Families

4.7 (591) In stock

4.7 (591) In stock

As the nation’s largest affordable housing development program, the Low-Income Housing Tax Credit has substantial influence on where low-income families are able to live.

Federal tax credit for multi-generational home renovations good start but not enough, experts say

How a Tennessee housing policy concentrates poverty, denies opportunity - MLK50: Justice Through Journalism

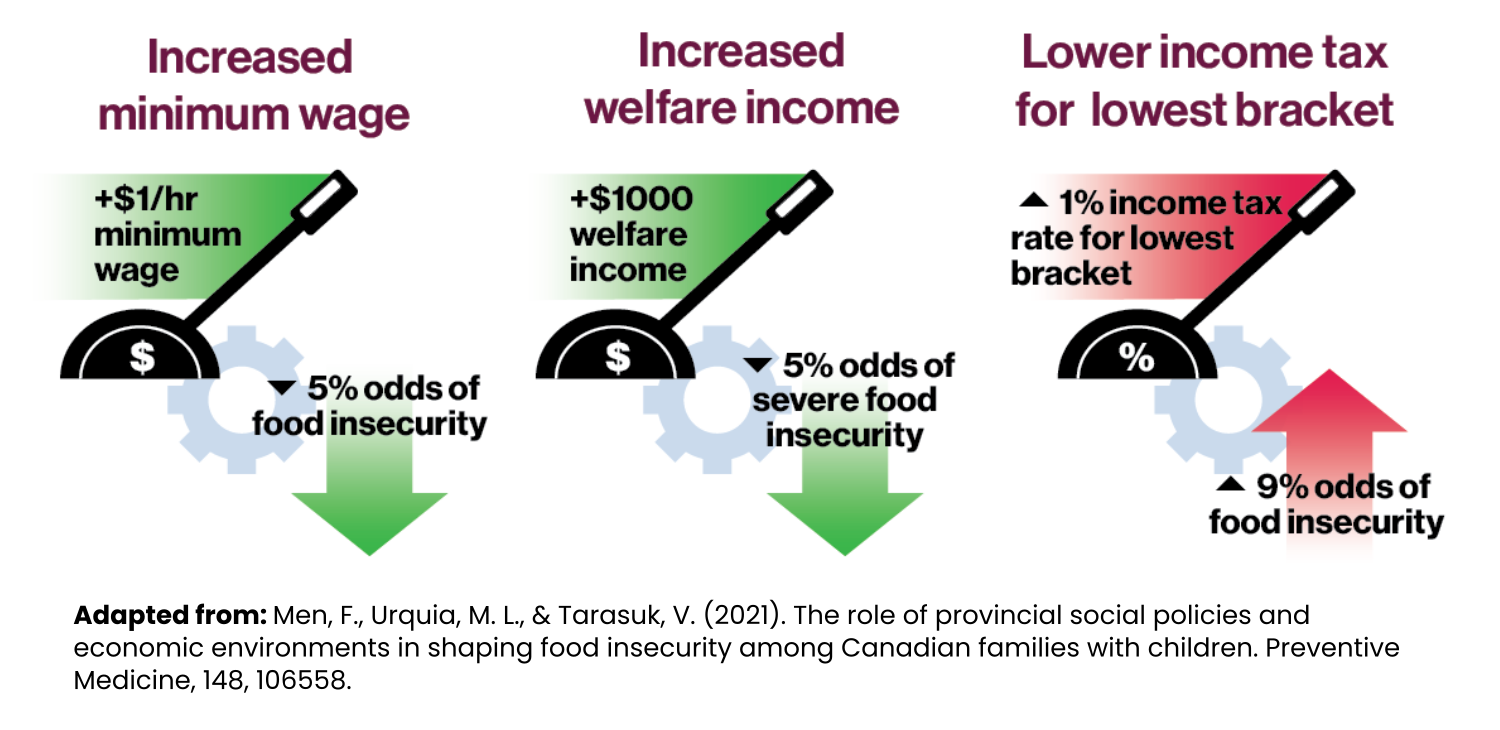

What can be done to reduce food insecurity in Canada? - PROOF

How The Percent Tax Credit Program Works National Housing

Closing The Divide - Enterprise + FHJC, PDF

Congress May Expand The Low-Income Housing Tax Credit. But Why

How to Reform the Low-Income Housing Tax Credit Program

Series: Low Income Housing Tax Credit Spending Difficult To Track, Measure

The Child Tax Credit Could Have Helped Fight Inflation

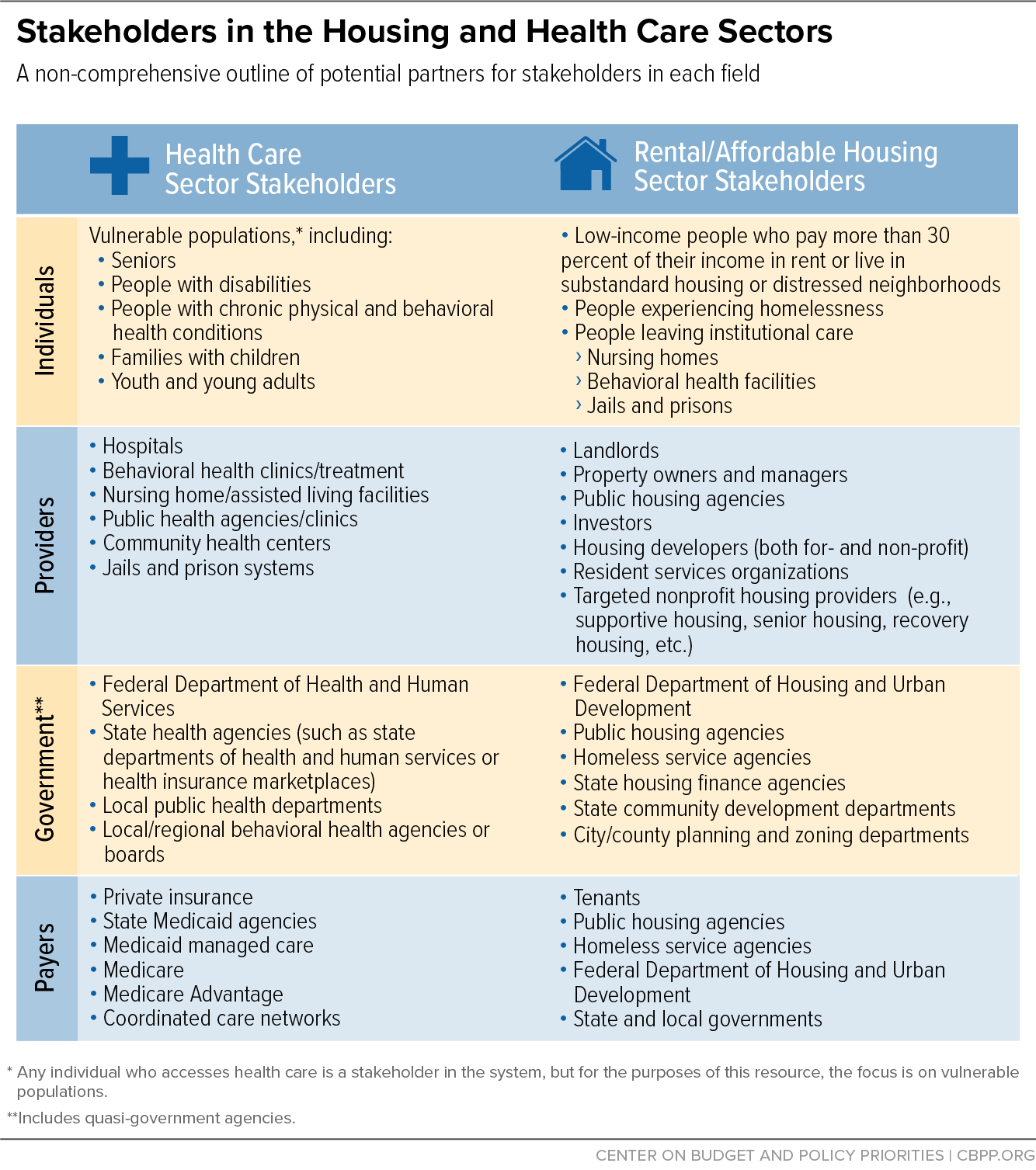

Housing and Health Partners Can Work Together to Close the Housing

Tax credit bills may send $1B to poor families - CalMatters

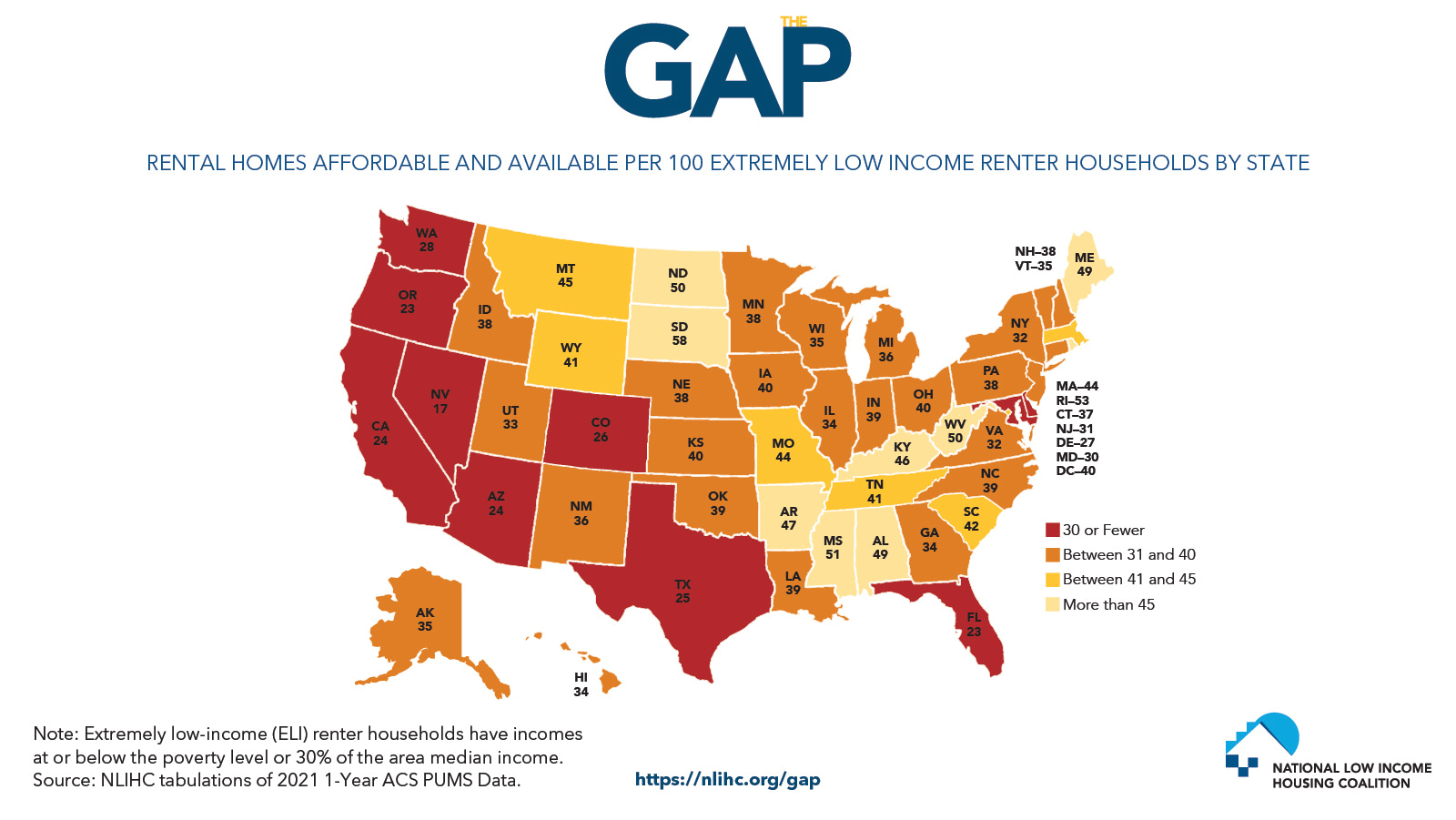

NLIHC Releases The Gap 2023: A Shortage of Affordable Homes

Does the Low-Income Housing Tax Credit Contribute to Poverty

Groceries and Essentials Benefit: Helping People with Low Incomes Afford Everyday Necessities

Can I get low income housing with an eviction