Carry and Roll-Down on a Yield Curve using R code

4.7 (101) In stock

4.7 (101) In stock

lt;div style = "width:60%; display: inline-block; float:left; "> This post shows how to calculate a carry and roll-down on a yield curve using R. In the fixed income, the carry is a current YTM like a dividend yield in stock. But unlike stocks, even though market conditions remain constant over time, the r</div><div style = "width: 40%; display: inline-block; float:right;"><img src=

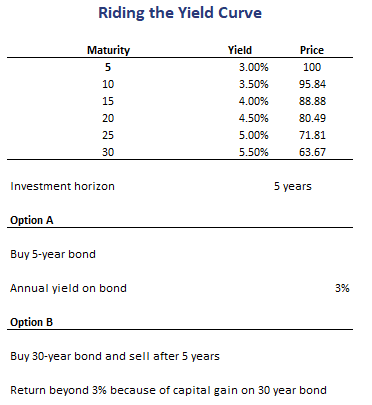

Riding the Yield Curve and Rolling Down the Yield Curve Explained

R code snippet : Transform from long format to wide format

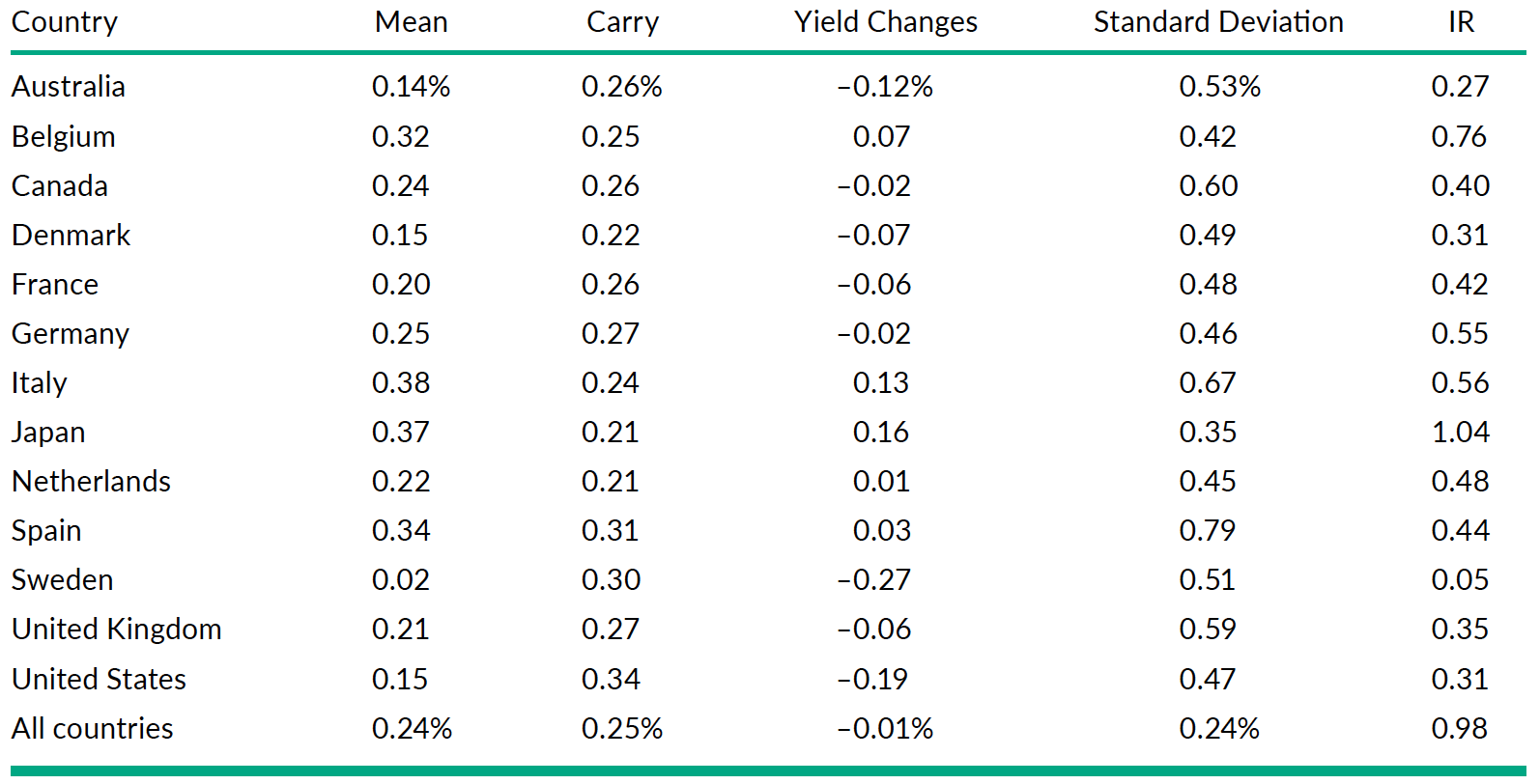

Fixed income carry as trading signal

R code snippet : Transform from long format to wide format

Riding the Yield Curve and Rolling Down the Yield Curve Explained

Corporate bonds: Unraveling Roll Down Returns in Corporate Bond Portfolios - FasterCapital

Riding the yield curve – BSIC Bocconi Students Investment Club

:max_bytes(150000):strip_icc()/Yield-Curve-6b685b5093f9425eada22cedf85d4d4f.jpg)

Yield Curve: What It Is and How to Use It

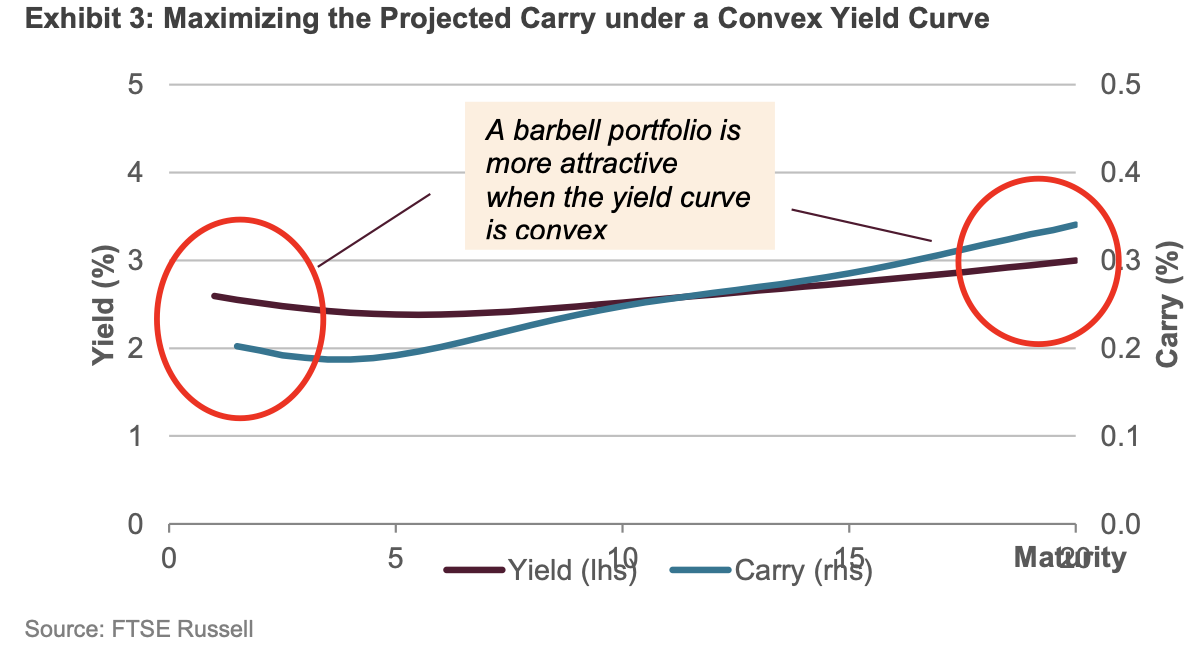

Yield curve: Analyzing Yield Curves in Carry Trade Decision Making - FasterCapital

139 questions with answers in YIELD STRENGTH

Carry and Roll-Down on a Yield Curve using R code

Riding the Yield Curve - Breaking Down Finance

Can you make money in fixed income in the age of The Zero?

Yield Curve - an overview

Riding the yield curve – BSIC Bocconi Students Investment Club