Australia Corporate Bonds: BBB-rated: 10 Years: Yield, Economic Indicators

4.5 (155) In stock

4.5 (155) In stock

Australia Corporate Bonds: BBB-rated: 10 Years: Yield data was reported at 4.510 % in Apr 2018. This records an increase from the previous number of 4.390 % for Mar 2018. Australia Corporate Bonds: BBB-rated: 10 Years: Yield data is updated monthly, averaging 6.810 % from Jan 2005 to Apr 2018, with 149 observations. The data reached an all-time high of 13.410 % in Dec 2008 and a record low of 4.090 % in Nov 2017. Australia Corporate Bonds: BBB-rated: 10 Years: Yield data remains active status in CEIC and is reported by Reserve Bank of Australia. The data is categorized under Global Database’s Australia – Table AU.M008: Corporate Bond Yield and Spread.

Australia Corporate Bonds: BBB-rated: 10 Years: Yield data was reported at 4.510 % in Apr 2018. This records an increase from the previous number of 4.390 % for Mar 2018. Australia Corporate Bonds: BBB-rated: 10 Years: Yield data is updated monthly, averaging 6.810 % from Jan 2005 to Apr 2018, with 149 observations. The data reached an all-time high of 13.410 % in Dec 2008 and a record low of 4.090 % in Nov 2017. Australia Corporate Bonds: BBB-rated: 10 Years: Yield data remains active status in CEIC and is reported by Reserve Bank of Australia. The data is categorized under Global Database’s Australia – Table AU.M008: Corporate Bond Yield and Spread.

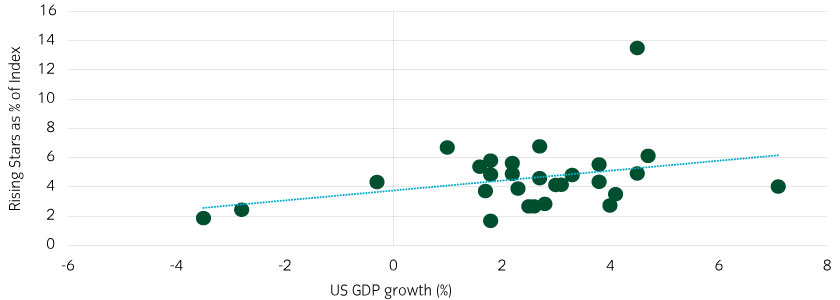

US High Yield – Different This Time Around?

Understanding Fixed Income & Bonds

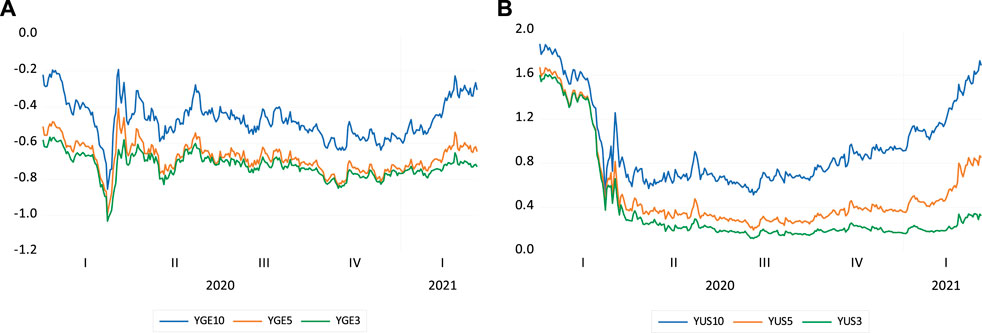

Frontiers The Impact of COVID-19 Pandemic on Government Bond Yields

New Measures of Australian Corporate Credit Spreads, Bulletin – December 2013

Seeking yield? Go east

Bond market wakes up from its hypnosis

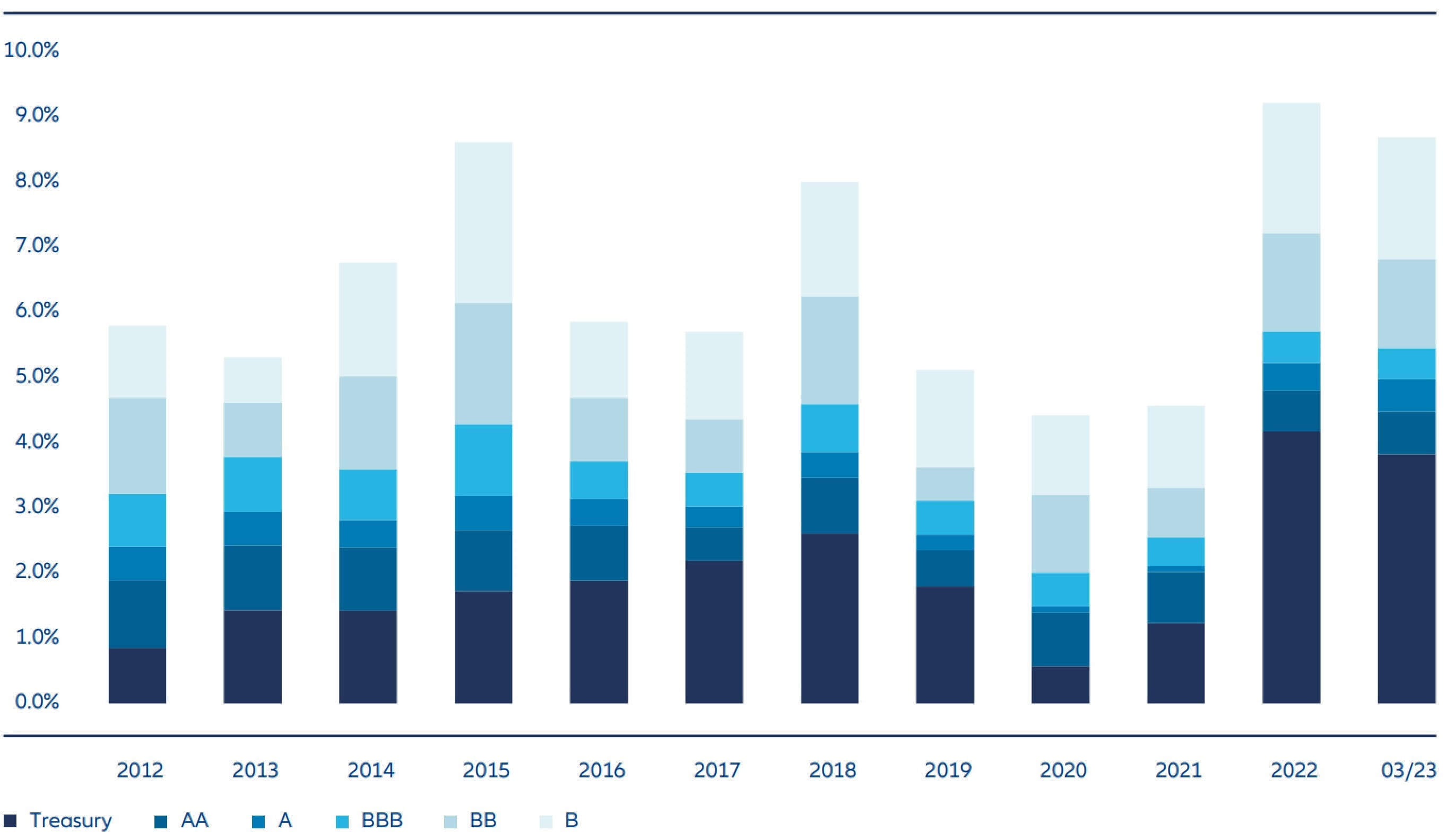

Credit Insights: Embracing the great BBB convergence

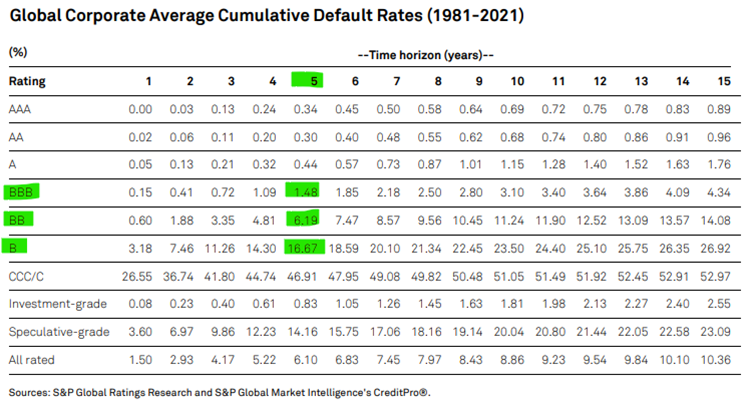

S&P default rates and the risks in bond investing

US investment grade credit – does quality now come with yield?

Credit Trends: Global Financing Conditions: Bond Issuance Set To Remain Weak Through Year-End, Expand Modestly In 2023

2Q 2019 - Fixed Income Market Review